Mapping out your levels is going to be the most important core skill for any serious trader. If you have trouble marking your S/R levels accurately, then your trading as a whole may implode… violently.

What is built on a weak foundation will eventually crumble

Everyone is going to have a slightly different approach to getting their charts marked out, but it is the end result which counts.

I’ve seen some Forex sites posting up their opinions of support and resistance levels so you can just check in from time to time, clone those horizontal price levels on to your chart, and not have to think about the process at all. This is not the right way to go about becoming a legitimate trader.

Marking support and resistance is Forex 101 – once you learn the easy process of marking out price levels, you won’t need anyone to supply you theirs. Think about it in this way; It’s really like cheating on a test – you could be copying the wrong answers, you don’t learn anything, and won’t grow as a trader.

If you’re reading this, then you probably don’t want ‘a free lunch’ and have the thirst for knowledge with a goal to improve your own chart reading skills. Build good habits early and they will stick with you forever.

I am sure you want to be able to independently, and confidently read a price chart – if you’re just piggy backing off of someone else’s opinions, you will never truly get there. So today, I am going to show you the processes I use to plot support and resistance.

You don’t need any fancy tools – just your own eyes to scan the price charts. It will be a major determining factor in how successful you are as a trader!

In this tutorial, I am going to cut through the confusion, and introduce you to the powerful basics of marking support and resistance.

Stop Making Support & Resistance A Complex Task

I see all these charts getting posted around on forums, and they look like a child’s finger painting drawing, or the NASA control panel for space missions.

This is an epidemic with traders and it is really screwing with their ability to ‘read’ a price chart. Most truly believe that being complicated gives them a competitive edge over their fellow market participants.

Sound familiar?

With this sort of mentality, traders are really driven to go overboard in the hope they cover every technical basic possible, and make sure nothing ‘slips under the radar’.

In order to gain any traction with trading, I truly believe the best place to start is with a clean price chart with some crucial levels marked out, and that’s it. Once you can read a chart using price action and S/R levels, your trading will improve no matter what other strategy you decide to use.

Have a look at the chart example below – it’s a classic example of a Forex trader who takes things a little too far!

This Forex trader has created an environment that is not practical, and just too difficult to work with.

There is absolutely no need to over analyze like this – it’s extreme overkill. If your chart looks anything like this – you can fix this right now as a positive step towards better trading.

If you are working with a Forex chart polluted with meaningless horizontal levels, and other unnecessary variables like: trend lines, channels, or even a stack of indicators – making a confident trading call is going to be extremely frustrating.

A badly laid out chart is poison to your trading mind-set. It’s very hard to make logical, rational decisions from confusing data. You endanger yourself to falling prey to your emotions.

The idea is to be minimalistic with the charts and the markets.

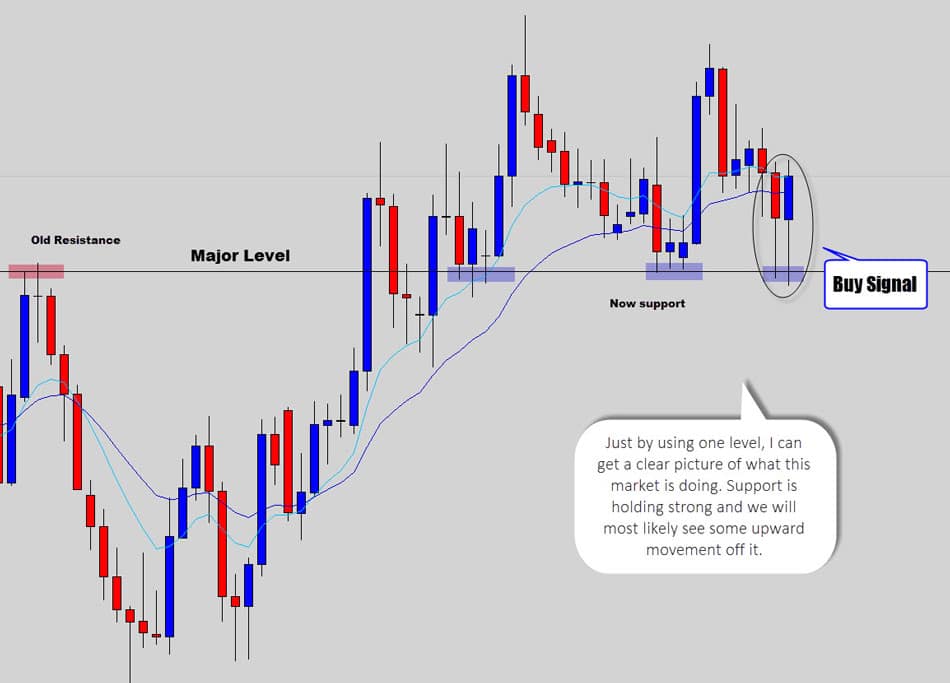

In fact, you only need to mark out the significant levels that are surrounding the current price movements at the given time. In some cases we will only have 1 line marked on our charts – as you may have noticed in our Forex market commentary.

You will find in most situations it only takes that ‘one well marked level’ to clearly map out, and help you clearly ‘read the situation’ on a price chart.

Seriously, anything over 3 lines marked on the chart would start to be considered too ‘busy’ and need some cleaning up.

By only marking out the important levels to watch you will keep your charts tidy, simple, and easy to read. This gives clarity back to the chart and to the trader – allowing the identification of good trade setups, and making the anticipation of future price movements much easier.

Checkpoint

Understanding support And resistance

Support and resistance levels are proven price areas where buyers and sellers find some form of equilibrium. We generally see a shift in the balance of power between buyers and sellers occur at these levels – this ‘power shift’ generates the classic price reversal patterns we are always on the look out for.

Therefore true support and resistance levels are the major turning points in the market.

Price doesn’t move in straight lines as you are most likely aware of – instead we see price swinging up and down, creating new swing lows, swing highs, or re-testing existing ones.

The more often price does this ‘stop and reverse’ action at a specific level – the ‘stronger’ or more’ significant’ that particular S/R level becomes.

Price is communicating to you that “this price level is being defended aggressively”, and could be a good area to look for reversal signals.

It’s also worth noting that support and resistance levels that are clearly visible on the higher time frames are considered to be greater in value, and have an increased chance of becoming a price turning point.

Just remember; the higher the time frame, the more significant the S/R becomes.

When we draw our S/R levels – we work on the daily time frame the majority of the time.

I recommend using weekly and monthly charts to mark out the more significant or ‘major’ levels in play. These weekly and monthly levels are really good areas to watch out for strong candlestick reversal patterns, like the rejection candle reversal – especially if you’re going counter trend.

Intra-day levels are generally not worth worrying about, price cuts through these like a hot knife through butter on a day-to-day basis and don’t offer much technical value.

This is one of the reasons intra-day or ‘day trading’ is much more difficult and has a very low success rate. You’re definitely trading on a shaky foundation when you ‘hone in’, or tune your analysis on those lower time frames – it’s not worth it.

Checkpoint

Working with Support & Resistance in Range-bound Markets

Lets get a little bit more practical and move into some technical demonstrations.

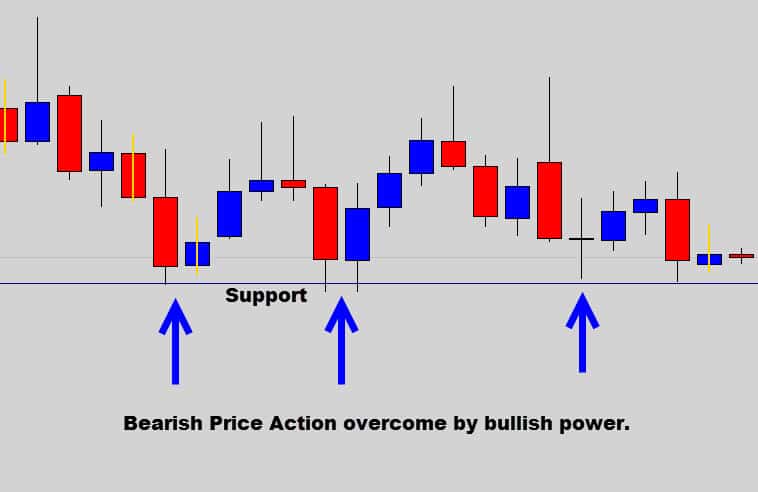

Support is an area on the chart where the market demonstrates strong buying action, easily identifiable by price ‘bottoming out’ caused by bearish price action movement being overrun by bullish pressure at a consistent price horizontal level on the charts.

Support is often referred to as the ‘floor’ that price bounces off, or has trouble moving past to the downside.

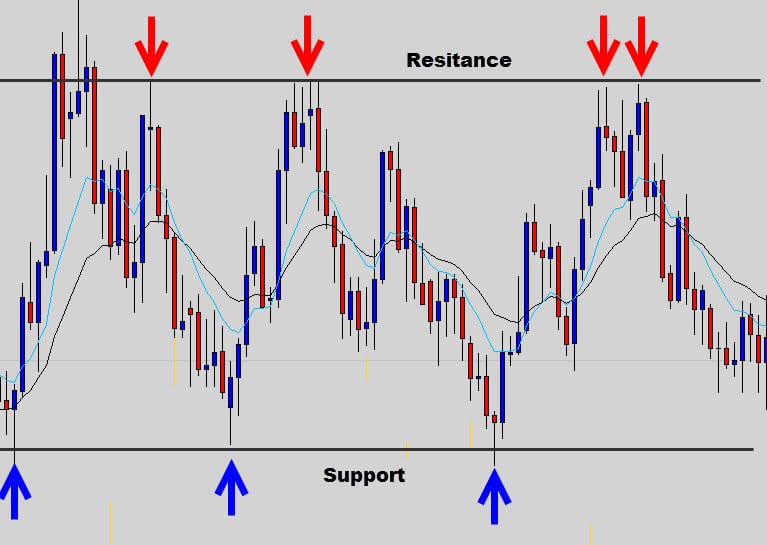

Resistance is the opposite of support – it’s where you see price ‘topping out’ as the bullish price action movement is consumed by bearish activity at consistent price levels on the charts.

Resistance is known as the price ‘ceiling’ that the market tends to fall off, or has difficulty pushing through to the upside.

Support and resistance is fairly simple to understand when you look at ranging markets – they make up the major containment lines of range-bound systems.

When a market is range-bound, the only levels you really need to have marked out are the upper resistance ‘ceiling’, and the lower support ‘floor’ of the range.

We recommend to only trade buy or sell signals from these main upper and lower boundaries. Short signals are valid at range resistance, and long signals are to be targeted at the range support.

Checkpoint

Trending Markets

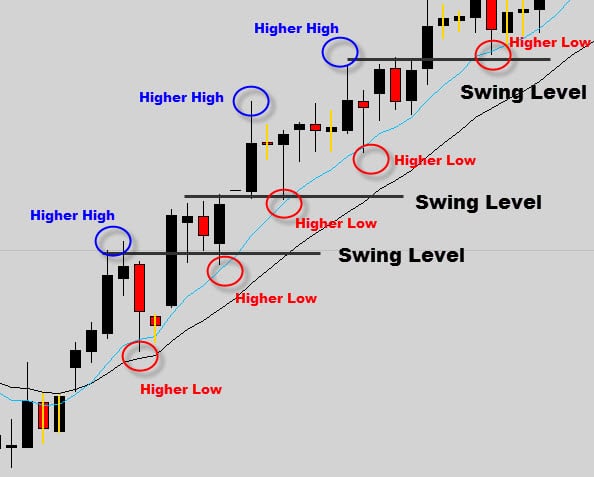

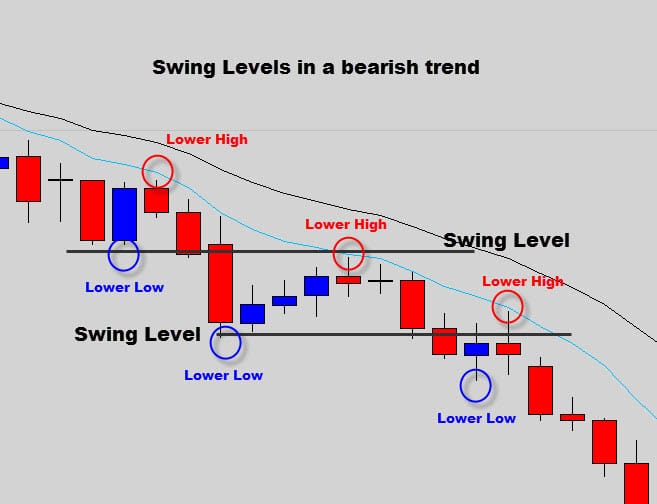

Trending markets are identified by using swing patterns that are broken down into classic sequences higher highs, higher lows, lower highs and lower lows (not in that order).

These key technical high and low points are called ‘swing highs’ and ‘swing lows’, and it is the order which they appear on the chart is vital to identifying trends, especially if you want to catch them in their early stages of development.

During a bullish trend, price will step upwards in a zig-zag type pattern – almost like price is walking up a flight of stairs. Price will gradually step its way higher forming that ‘staircase footprint’ on the chart.

Higher highs (or swing highs) in bullish trends is where the market finds resistance, and generally starts off a correctional move.

Higher lows (or swing lows) normally are formed after a counter trend correction is terminated, and the market finds its footing (support). Trend momentum kicks back in here and generally pushes price into the next higher high to complete the next phase of the trend.

During a downward bearish trend, the opposite is true.

Notice the ‘staircase’ upward motion – price is finding support and resistance at the swing highs & swing lows, as it moves in the general upward direction.

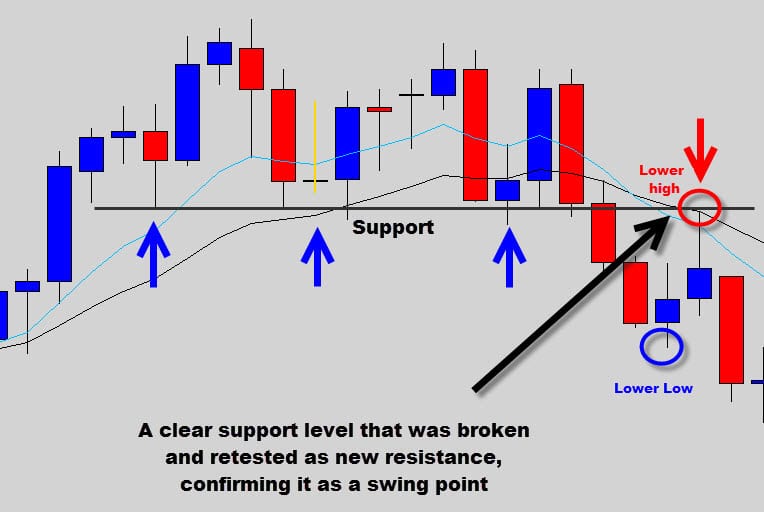

In trending markets, the critical levels that we recommend to mark, and watch are the ‘Swing levels’ – which is one of the main principles of swing trading.

Swing levels are ‘hot zones’ for price reversals and trend continuation – so they want to have your full attention.

They form when old resistance turns into new support, or vice versa. Basically, the level reverses it’s role from old support to new resistance, or from old resistance to new support. A very important technical event on the chart.

Or if I put it another way – swing levels are when a swing high acts as a new swing low, or an old swing low is used as a new swing high. Study the chart above and you will see each swing level lines up swing highs and lows on the horizontal plane.

Price Action signals that generate off swing levels during trends have a high success rate, that’s why I call them the ‘hot spots’.

There are two main reasons for this; Firstly, there is already trend momentum backing the trade, secondly a swing level – which we know is a key turning point in the trend, adds to the chances that the trade will move in your favor.

Here is an example of a bearish trend and its related swing levels.

In this downtrend we have marked out the swing levels (where old support levels have turned into new resistance).

See how in a bearish trend, the staircase footprint price travels through is inverted to the bullish trend – just think of someone walking down the stairs this time.

Checkpoint

The Weekly and Monthly Support & Resistance

On a larger scale, strong weekly and monthly support and resistance levels should be marked on your chart when the current price is the vicinity, or approaching those levels.

These weekly price levels that are dominant from these higher timescales are major turning points in the market, and want to be paid close attention to.

Strong daily price action signals that occur at significant weekly or monthly S/R can be the catalyst for a strong reversal move – and create very profitable trades if you have the discipline to hold a trade open for a longer duration.

In the GBPUSD chart above – you can see how this support level was acting as strong weekly support, and had been a key turning point in this market.

Now because price has broken through this important level – the best course of action is to wait and see if the market will now respect this old weekly support as new resistance.

We can confirm this if a bearish price action reversal signal forms when price retests the old support. It’s all about letting the price action tell you where it wants to go.

Don’t assume something is going to play out the way you think, and take action too early – the market will teach you a harsh lesson for doing that.

In the examples above, we’ve identified the key support and resistance levels on the chart without cluttering up the template with any indicators, trend lines or other chart tools.

Only mark out the important levels that market is currently reacting with at the present time. I don’t think the market cares too much about levels from 10 years ago.

Just concentrate what’s going on in the ‘now’, because support and resistance levels do change over time.

Remember – the market is not static, it’s a dynamic environment. Support, resistance & swing levels will change as the market dynamics change.

By sticking with the levels the current market is respecting, you can keep your hand on the ‘market pulse’, tuning you in to current conditions. Do this and logical, confident trading decisions will flow much easier, so long as you are basing your decisions on what a simple price chart template is communicating to you.

Checkpoint

Support and Resistance Take Home Notes

A few points to remember from today’s tutorial…

- Mark upper resistance and lower support in range bound markets

- When price breaks a support or resistance level – mark it on your chart and wait for a signal to confirm it as a new swing level

- During trending conditions – mark higher highs and lower lows and wait for them to be confirmed as a swing level via a price action signal or a price bounce.

- Mark the support and resistance levels on your chart that are dominant on the weekly and monthly chart, but only around the area where current price is located (no need to go back years and years ago).

- Remember the higher the time frame, the higher the significance, the higher chances are of success.

I truly hope today’s guide to identifying support and resistance levels has given you some new insight on how to structure your charts, and plan your trades more effectively.

Don’t expect to nail it immediately just from one pass of this lesson. The ability to draw levels correctly is learned over time and with patience – so don’t give up, learn to avoid common mistakes when traders draw support and resistance.

If you’ve stuck with crowed price charts that are overloaded with a horde of support and resistance levels (and indicators to boot) – then you’re going about it the wrong way. Scrub your chart clean, start again and use the methods discussed here today to keep trading nice and simple.

Acquiring the skill of correctly marking out support and resistance is obviously very important for any Forex trader – but we’ve only scratched the surface here in today’s introduction.

If you’re serious about learning how to read plain price charts to anticipate future price movements, and make high probability trade calls – you would greatly benefit from our war room membership for aspiring price action swing traders.

The War Room is our private membership area where you will learn more about price action strategies, and gain access to advanced ‘war room’ only material – like our 1 hour video presentation on identifying and using support and resistance levels.

There is also the Price Action Protocol course and the community aspect, like the chat room and forum where we are bouncing trade ideas off each other all the time.

I hope to see you on the other side, cheers to your future trading!

Chimex

I would love to know about! support and resistance levels. Because I’m new into this business ❤️🙏

Loba 1

I enjoyed the lesson and am still going through it again now as fresh to understand better . Thanks

Paulo

Exelente sucesso

innocent nonso

Honestly this really help me in trading skills

AMOUZA NLASSIMDI

Very helpful, I have learned a lot, thanks.

Nyacks

Hey, I’ve found this information very impressive and informative. Stay positive. Salute!

Paulo carneiro

CoMo sempre excelentes orientações .

Ramphal Gosine

Very very informative,I’m impressed, everything you said has been proven to be accurate.

Vife

Please what moving average do have on the chart used in this article

https://www.theforexguy.com/how-to-draw-support-and-resistance/

Replying to: Vife

AcharyaK

Dale uses 10 & 20 EMAs.

Georgina

Interesting and informative thanks

FAISAL khalifa

Thanks for this value information

Dr. Altaf Hossain

Wow!

What a nice piece of article explaining S & R. No one better explained it before.

I enjoyed and hope to practice in your way and trade based on this. Thanks and best wishes.

supertricolor

Qual a configuração da media móvel que vocês utilizam nos exemplos?

Januário

Yeay Forex Guy

U good?

I need to know how many time should I go back to mark my levels?

Replying to: Januário

Dale WoodsAuthor

Just check the weekly chart for the major levels which are relevant to price at the moment.

Praise

Hey Dale.. Amazing writeup here! You’re style of teaching is real cool.. I’ll need your advise and help on a couple of things including brokers.. What’s the fastest and easiest way of reaching you?

ZHANYONG

Thanks very much for lesson. When I draw the Dayly S/R, is it what I will be using to analyse the H4chart?

Replying to: ZHANYONG

Dale WoodsAuthor

That’s my general approach, bigger levels from your top down analysis are really where you look for the market to turn around. Don’t waste your time with weak intraday levels.

Chisamac

Very insightful for a beginner like me. I read a lot of material that was almost getting me confused but now I can clearly see the light. Thanks buddy!

JP golden

Thanks for ur teaching, the best I ever came across, pls i will like to join the war room, how do I join. Am new and still on demo

Jasco

Hi Dale,

This is very useful material, i am still going through the course and i must say this is good.

I am only on part 3 of the course and i just cant stop.

ALEX

HI DALE GREAT ARTICLE , THANK YOU , KEEP UP THE GOOD WORK ! 🙂

Akpan Hope

Hi there,

I’m commenting out of Nigeria. i must tell you that this has been very helpful. Please I will need more info as to how to become a member of your WAR ROOM. Hit me up ASAP. Thanks….

john

opened my eyes learned a lot very good easy to follow

H.Grewal

It was highly inlighting to study your article regarding How to draw suport and resistance line. The artcle was effectively simplyfied. It was east to undersatnd.

Moisés Pimentel

Excellent

Joubert Petrus Lesibo

Thanks the information is worth recognition. I will apply what I learned here. Thanks

Austin

Sir u make forex soo exciting and thanks much i believe ma passion has been fuelled by ur continued dedication to new bies here..Am overloy grateful broh its well explained.

Olatunde Adigun

Thanks Dale for your clarity in presenting the tutorial. I came across your site by chance , just a couple of weeks back. I haven’t left it since then. Keep the good job going. Kudos to you.

Aro

WOW! For someone (Me) who has been studying Forex Trading & Demo trading for the last 4 months, This lesson here beats ANYTHING else Ive learnt throughout these last 4 months! So clear & straight to the point! I will definately be studying the rest of your Website. Am hoping to go live once I fully understand the market which hopefully is before the end of the year. THANK YOU DALE!

GLYNN

An excellent tutorial.

Thank you

herbert andrade

Does DALE make me doubt the S & R ninel ALWAYS TRACING AT THE SAILS OF THE SAILS OR THE CUTTING OF THE SAIL BODY? WHY IN THE LINE GRAPH WHEN ALWAYS PUT THE LINE ON AND IN THE CANDLE OF THE CANDLE AND YES AT THE CANDLE CLOSURE? I SEE THAT IN THEIR VIDES ALWAYS IN THE SAILING PIECES

Josiah Omaduvie

Thanks very much for lesson. When I draw the weekly S/R, is it what I will be using to analyse the daily chart?

Erickson

How does the mean value of the 10 and emas works?

sentosa masyhor

thanks mr dale woods i must joint you nexs time. if i have money

Bgomes

Thank you my friend, this is a very precious piece of info. Cheers

Busuyi

Thank u Mr Dale for this write up…its simplicity makes it understandable…I could see u include EMA into your trading and it also help in identifying some of the turning point of S/R…You are really doing a great job here helping people how to trade well without losing there hard earn money…Thank you and God bless you.

Deepak Hatkar

Master, what is the purpose of the 10 and 20 EMA. What does it tell you? How does it help in price action trading?

Zaim Omar

Thank you, Dale. I wish I found this sooner before losing my money. T T. I wish I could see more example of support and resistance. I am a newbie. Making mistakes over and over again. Wish you blessing Dale!

Peter Miller

Thanks Dale, I like very much your very disciplined and sensible approach to trading and I appreciate very much your lessons on line and what I like the best is that you always respond to peoples questions which is very reassuring to us new traders.

Regards

Peter

Arif Ahmed

Nice, It has opened my eyes. Very, Very Good work. Thanks.

Arif from Bangladesh.

BEN

hi dale , i thank you so much for the time you have taken to educate new traders like me,

please how can i also use the weakly and daily charts to find resistance and support levels, then use this points to trade with a small account like $100 account since the longer the time the longer the stop loss which could be a risk to my account?

Tau

Hi Dale,

Thank you very much for your lessons. I m trying hard to learn how to draw Support and Resistance. How do i join your war room so that i have access to your videos? you also mentioned something like this is just the begining for S/R what else is required for one to learn this thoroughly.

bujang

thank you for showing us the simple side of chart analysis.

bujang

thank you for showing us the simple side of chart analysis. how much room do you leave for error? for example when you open a trade, how big is the margin that you will set the stop loss at? do you measure them in pips or in actual money?

Johnfaith

Hello Dale, I highly appreciated all the tales of S/R, I have also watch your videos, but how can I join the war, and get the candle alert and what it will cost me

Thanks ,Johnfaith

A.D.Kajarekar - India

Interesting lesson!

learnt a lot.

Also it needs practice for identifying as specially swing levels for benefiting in case of trend reversal.

But I am confident that this is the easiest method from all other I have gone through so far.

Thanks to the author Mr Dale Woods for sharing his hard earned knowledge.

Clint

Hi Dale, I am based in South Africa and i have just started trading on my demo account to better my skills before i open a real account. I am battling with my S&R lines as the person i am learning from has not explained it correctly. Looking at the way you draw yours is so much clearer.

I was told to use line charts and draw my structure lines from monthly, daily and then weekly within my period separators.

Would you recommend i do this?

Replying to: Clint

Dale WoodsAuthor

No, because line charts only show 1 out of 4 data points of the price moment, the close price.

Candles and bar charts show you the high, low close and open price of price action – which are very important.

scott

Hey Dale would you mine making a video drawing your support and resistant level

Markus Izang

I appreciate this. Thanks

neville

Nice article Dale, every time I read your new post I learn something new. Keep it up.

Carlier

Hi Dale.

Many thanks, your explanations are clear, to the point and easy to follow and understand. I am delighted to have found your site and very grateful for your kindness in sharing your knowledge with us. I wish you all the best. Jacques.

Kris

Hi Dale this is incredible , for me was hard to anderstand higher high and lower low which on are ther it’s hard to see their is lots of them look very same please help I would like to learn to make a money need to help lots of people . Thanks

Steve Epperson

Thank you again for this great information. I know it takes time to put together. Much appreciated.

Enver

You are a blessing for us new traders. ☺

Thank you for explaining in a wery simple way.

Enver

Douglas

Thanks for the read.

prakash

Hi Dale, I am currently focusing on daily charts on Indian stock exchange and also look at weekly for support and resistance, I request your help on the following:

At any given price, on the left hand side of the chart invariably there are many candles which gives conflicting signals of support and resistance, how do we identify which is a valid support or resistance, should we take swing lows and high’s for a trending market and high’s and low’s in a ranging market, can you please help with examples as I am still not clear

Replying to: prakash

TheForexGuyAuthor

You have to look at the market structure, which is most visible from the weekly chart. Mark the major turning points there. Then on the time frame you trade off, you can work with swing high and lows to identify / anticipate swing levels for trend continuation trades.

Muhren

Hi sir.

Love ur lesson. Do you have tradingview account. If u have one, that would be fantastic.

tee

hi Dale,

can i used horizontal line & trendline as SNR at the same time ? (due to my current trade GU in a trending market)

Replying to: tee

TheForexGuyAuthor

Sure, you can do that.

Palani

Hi Dale, thank you so much in taking this challenge to educate people like us, I like your approach on Discipline, patience and etc, Yes i agree with you. If you take it as a business then you must be serious and make it work. I also like the way you write, straight forward and shoot if you have too.

I am 2 months old in forex, attended 2 days class and started trading, losses were more than gains because we were taught on day trading more than end of the trading. Then i started thinking there must be something else i can do and i found your site. Thank you so much for sharing.

David brazzell

What is your opinion about adding donchian channels since they can show the highs and lows.

Replying to: David brazzell

TheForexGuyAuthor

I am a big fan of those channels, I usually call them ‘the turtle channel’ because that’s what the famous turtle strategy used. I’ve used them in some of my indicator projects.

Mr E

What do you think of using line charts to plot support and resistance?

Replying to: Mr E

Dale WoodsAuthor

Not really, the line chart only shows half the story. You can’t see important data like the range of the day and if any failed breakouts occurred. Line charts will give you a brief idea of what the market is doing but not the full story.

johnamirtharaj

great explain

Vieta

Clear description. Im new in forex an wondering if you can suggest any good forex broker to use. Thanks

Replying to: Vieta

Dale WoodsAuthor

Sure you can email me if you want to know more about brokers 🙂

Sam

Very good info for a newbie like me. Makes a lot of since. I just opened a forex trading account but have not made a first trade yet. I am trying to study first so I can actually make money instead of losing it. Thanks for the info.

Replying to: Sam

Dale WoodsAuthor

Thanks for the feedback Sam. Good luck on the charts!

yusoff shariff

Excuse me sir,. I see the master using two lines sma / ema. how do i know the average line

Replying to: yusoff shariff

Dale WoodsAuthor

They are the 10 and 20 EMA applied to the close Yusoff 🙂

Kyo

hi,i still confuse i SnR level how to draw in weekly and daily?

Replying to: Kyo

Dale WoodsAuthor

Try to only plot out the major turning points on the chart, these are the areas where you seen long term price reversals. The more times you see long term price reversals off these levels – the stronger, or more value the support or resistance level has.

mohd fauzi ismail

Which one is better to use as support and resistance? Body or tip of the candle?

Replying to: mohd fauzi ismail

Dale WoodsAuthor

A combination of both.

Bruce

One noticeable difference I see with your S&R as opposed to other I see, is that you place them at the extremes of the “pins” as opposed to others who use the body of the candles high or low for this.

Replying to: Bruce

Dale WoodsAuthor

I don’t really have any sort of rigid approach like ‘lining up wicks’ – I use my eye and mark the levels logically. I am looking for obvious turning points in the market from up high on the daily and weekly time frames. You will find that the market is a noisy place sometimes, and you won’t always get these clean support and resistance levels that we like to see, but more like ‘areas’ or ‘zones’.